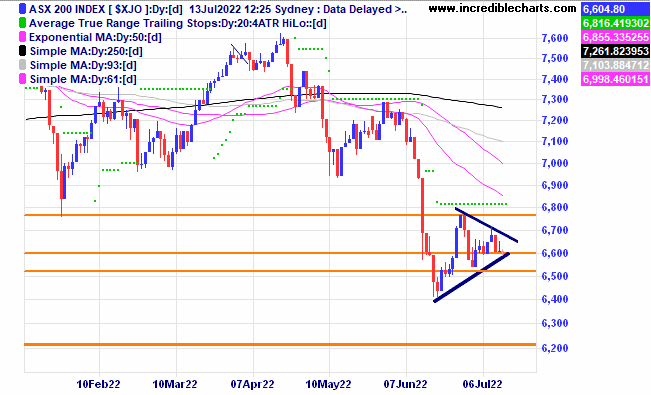

The local market continues to trade in a sideways pattern and looks to be struggling to make a fresh high. Watching carefully for any trading opportunity when it breaks out of consolidation.

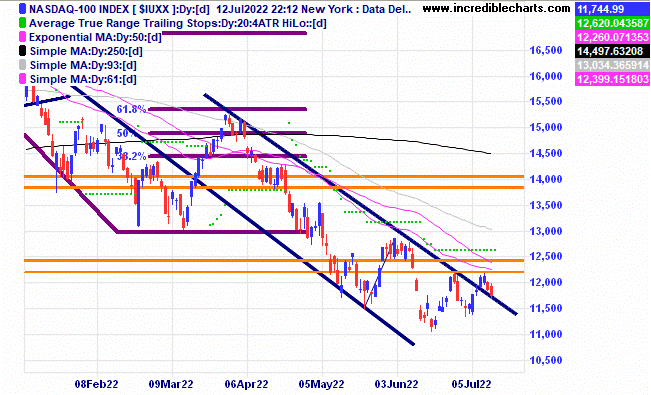

On a daily chart the Nasdaq has formed a higher low and is yet to punch through to make a new high. Any lower than forecast company earnings could weigh heavily on the index.

On a weekly chart the Nasdaq has retraced roughly 50 per cent of the 2018 to 2021 move.

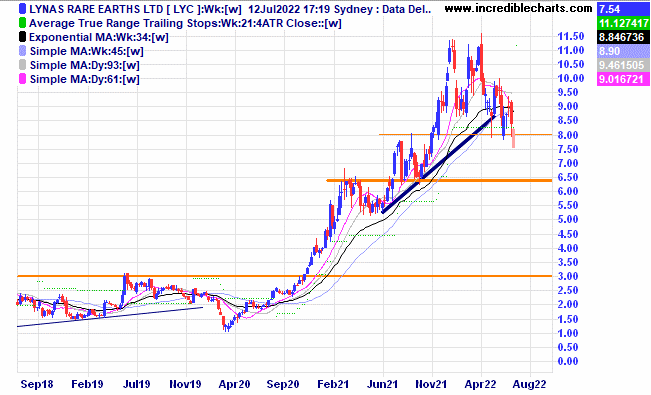

Lynas broke down through possible support and we sold.

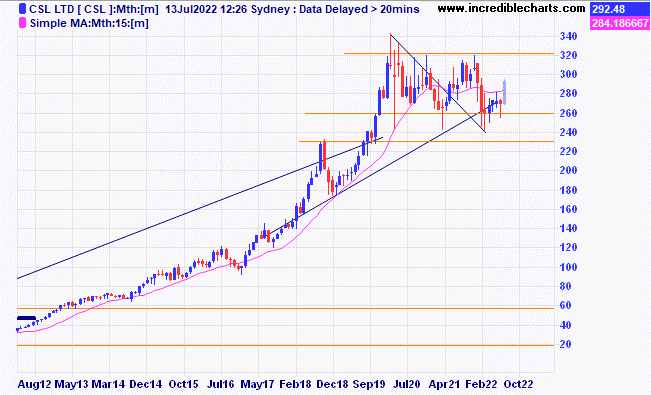

CSL has lifted off the bottom of the current sideways pattern.

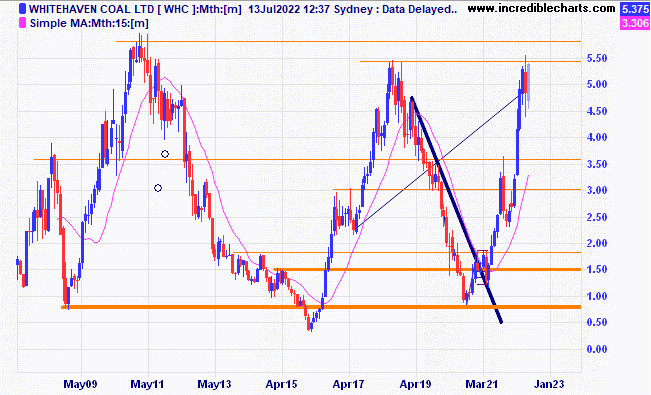

Whitehaven Coal has yet to break through overhead resistance as some analysts put a $7.50 price target on the stock.

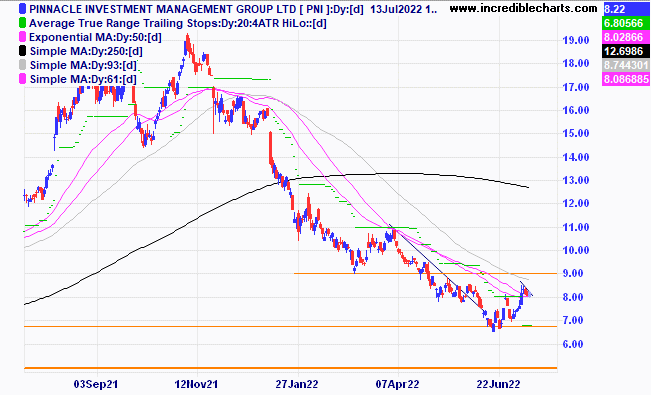

Pinnacle looks to be forming a small bullish flag pattern and we bought some today.

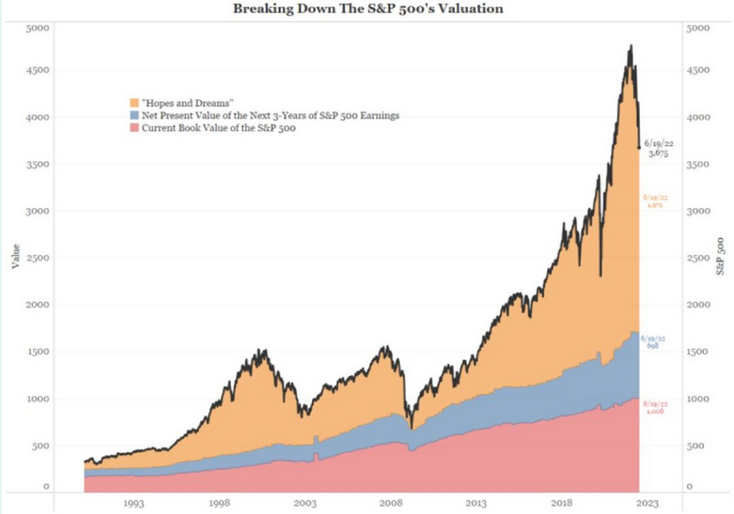

The US S@P500 index shown by price and earnings valuations with a very wide discrepancy. Look how far it is overpriced compared to historical norms.

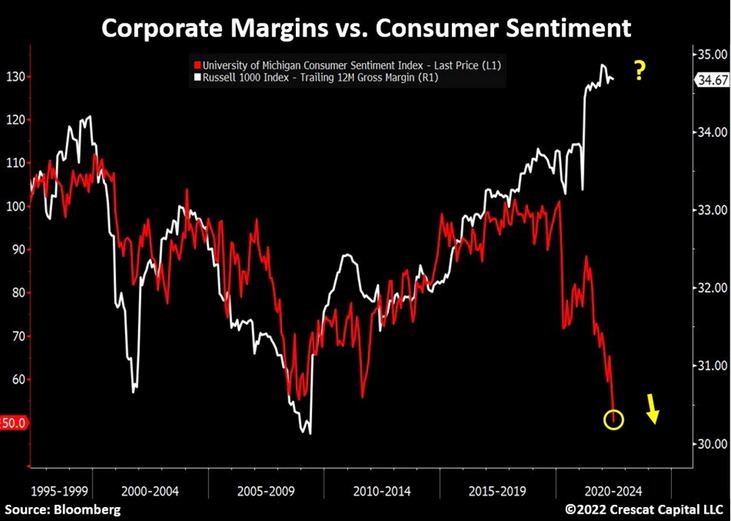

US corporate margins compared to consumer sentiment is way out of alignment compared to historic norms. Perhaps a bit of give from both sides is overdue.

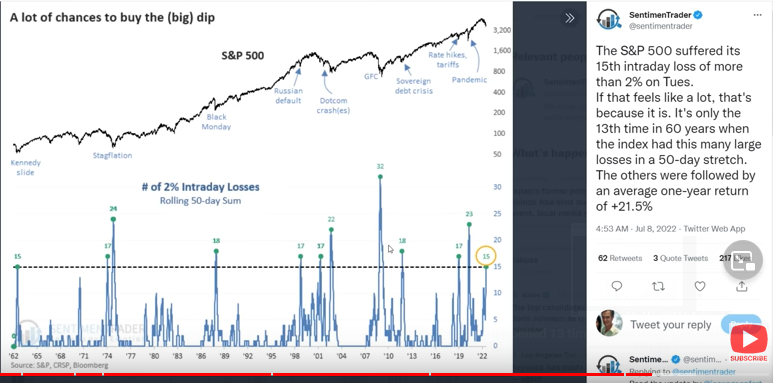

This chart of the number of down days over 2 per cent gives the bulls a glimmer of hope although a higher reading could see the market retrace further. Anyone say flip a coin?

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 300 at $2.70 | 23/12/2021 | $4.83 | $5.16 | +$99.00 |

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $24.97 | $24.56 | -$49.20 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $278.00 | $292.00 | +$168.00 |

Bought Lynas

| Bought 300 at $9.20 | 17/5/2022 | $8.99 | Sold $7.80 | -$387.00 |

Buy BBOZ ETF

| Buy 500 at $4.10 | 7/6/2022 | $4.69 | Sold $4.60 | -$75.00 |

Bought BBUS ETF

| Bought 100 at $11.20 | 10/6/2022 | $11.24 | Sold $10.90 | -$64.00 |

Bought Brainchip

| Bought 4,000 at 80c | 16/6/2022 | 94c | Sold 2,000 at 90c 2,000 left at 80c | -$110.00 -$280.00 |

Bought GGUS ETF

| Bought 100 at $24.00 | 27/6/2022 | $21.48 | $21.35 | -$13.00 |

Bought Clinuvel

| Bought 200 at $16.00 | 27/6/2022 | $16.01 | $16.20 | +$38.00 |

Bought Aristocrat Leisure | Bought 100 at $35.60 | 6/7/2022 | $35.60 | $35.77 | +$17.00 |

Bought Domino’s Pizza | Bought 40 at $72.00 | 6/7/2022 | $72.00 | $69.00 | -$120.00 |

Bought Life360

| Bought 800 at $3.50 | 6/7/2022 | $3.50 | $3.53 | +$24.00 |

Bought Nasdaq ETF

| Bought 100 at $27.00 | 7/7/2022 | $27.00 | $27.00 | Steady |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $56,756.85 |

| |

| $56,756.85 |

| Gains/losses week -$752.20 |

|

|

| -$752.20 |

| Current total $56,004.65 |

|

|

| $56,004.65 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $27,220.20 |

|

|

| $27,220.20 |

Prices from Tuesday night or 6am for US positions. | Cash available $28,115.20 |

|

|

| $28,115.20

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here