The local market is holding above the break out zone in a sideways congestion for now. Will the strong seasonal effect kick in soon?

The US based Dow Jones Index has retreated from close to the 40,000 level for now.

After heading downwards for some time the Hong Kong stock market could be forming a basing pattern here.

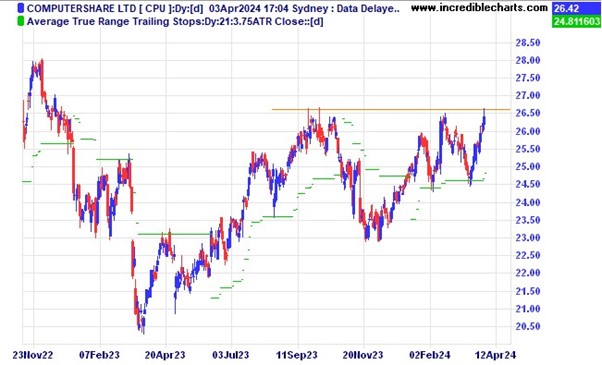

One beneficiary of the higher for longer rates scenario could be Computershare which is bumping up against a resistance zone for now.

Mineral Resources looks to have broken the down trend line and could soon be on the rise.

The Bank of Queensland is lagging the majors in price movement this year and has just moved above a level of resistance.

REA Group is holding above the break out zone for now.

Wisetech pushed below a current support level. Is this a warning of lower prices to come or just a blip on the radar?

Woodside Energy is yet to see much price movement on the back of higher oil prices.

An interesting chart of Whitehaven Coal. Notice the recent spike low.

Gold Miner Northern Star has just moved above a resistance zone on the back of a strong gold price.

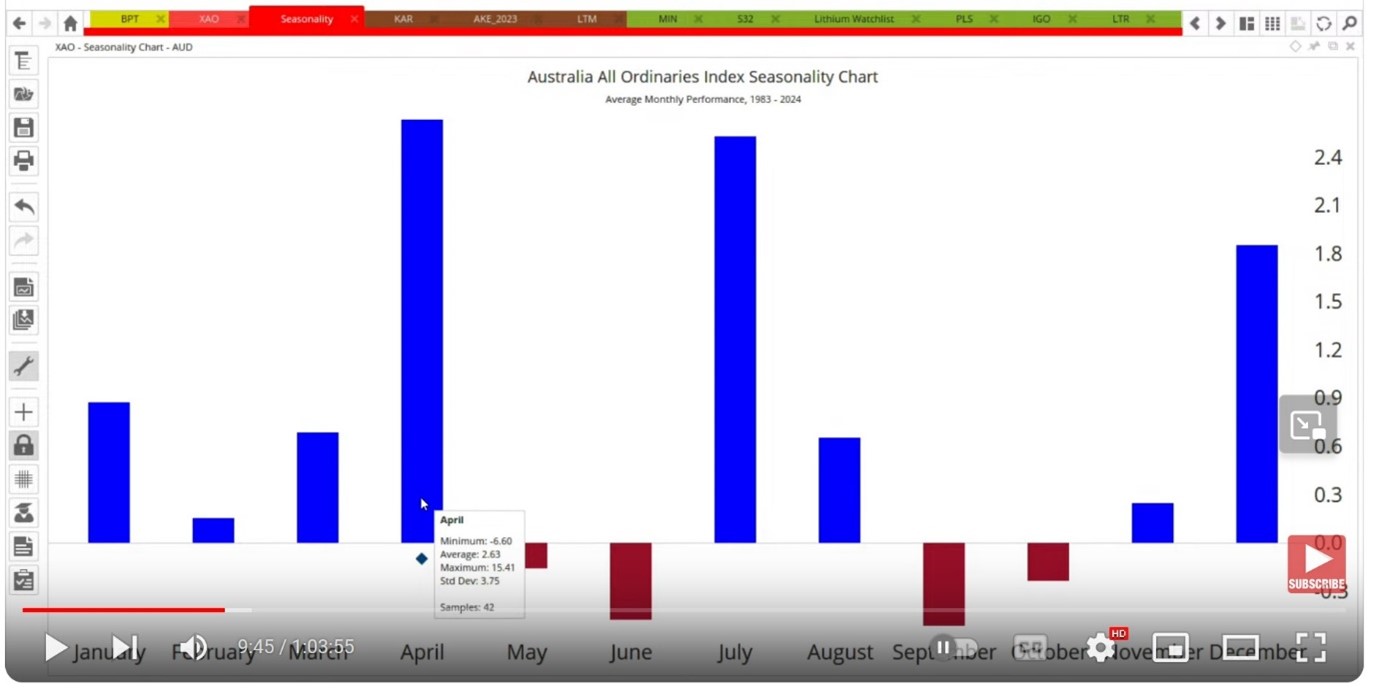

A seasonal take on the Australian All Ordinaries Index which shows April as one of the stronger months on average.

One look at the seasonal chart of the Japanese stock market.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here