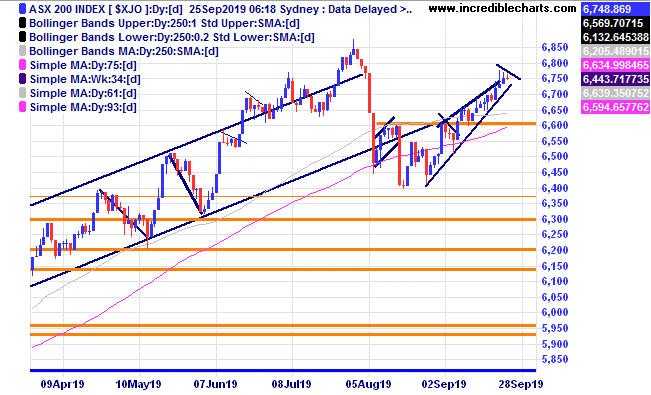

The local market looks to be consolidating the move to the recent highs on the monthly chart.

On the daily chart two inside days in a row show the markets indecision at the end of what appears to be a weak rally. The fall in this morning’s trade may well lead to a fall all the way down to the recent support level around 6,600 points.

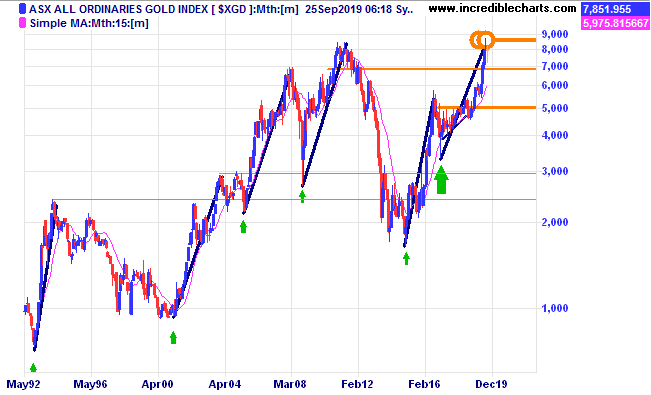

The local gold index over the years has had a tendency to rally a minimum 210 per cent from the lows. The present rally off the last spike low has reached around 150 per cent. Is this the end or could we see this leg rally higher into new all-time highs?

After last year’s seasonal flop one wonders how the main US index will perform in the last quarter this year.

Avita Medical is one of those stocks promoted up the scale in the latest ASX index rebalancing and looks to be consolidating the recent breakout.

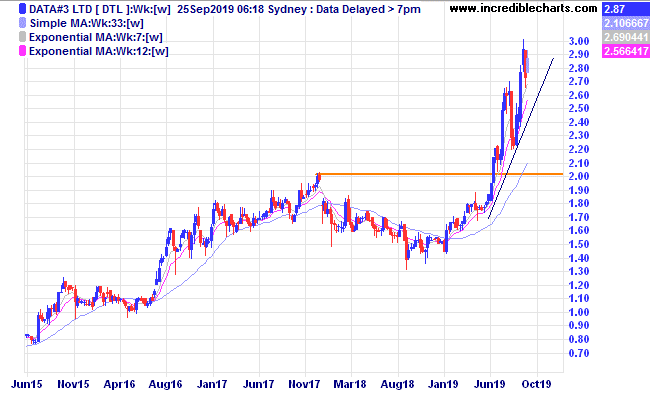

Data #3 has had a nice run up of late and has also been moved up on the index rebalance.

Clean Tech Holdings is one of those companies that were downgraded in the recent rebalance and could be forming a higher low.

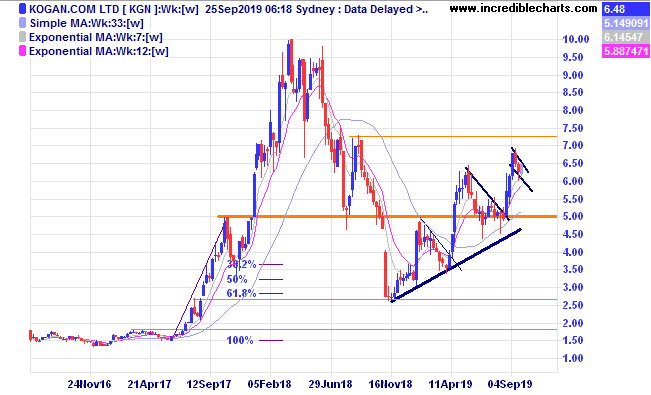

Kogan looks to be forming a bullish flag type pattern on the weekly chart and also has an interesting looking pattern on the monthly chart.

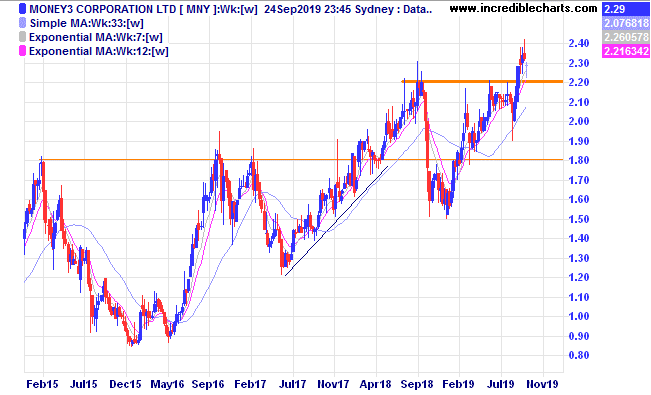

Money3 Corporation looks to be consolidating the recent move up and we will look to add some to the educational portfolio.

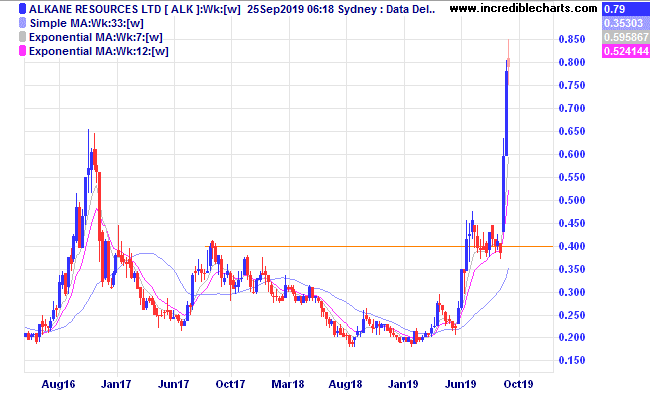

Alkane Resources has moved up a rapid 80 per cent since the breakout.

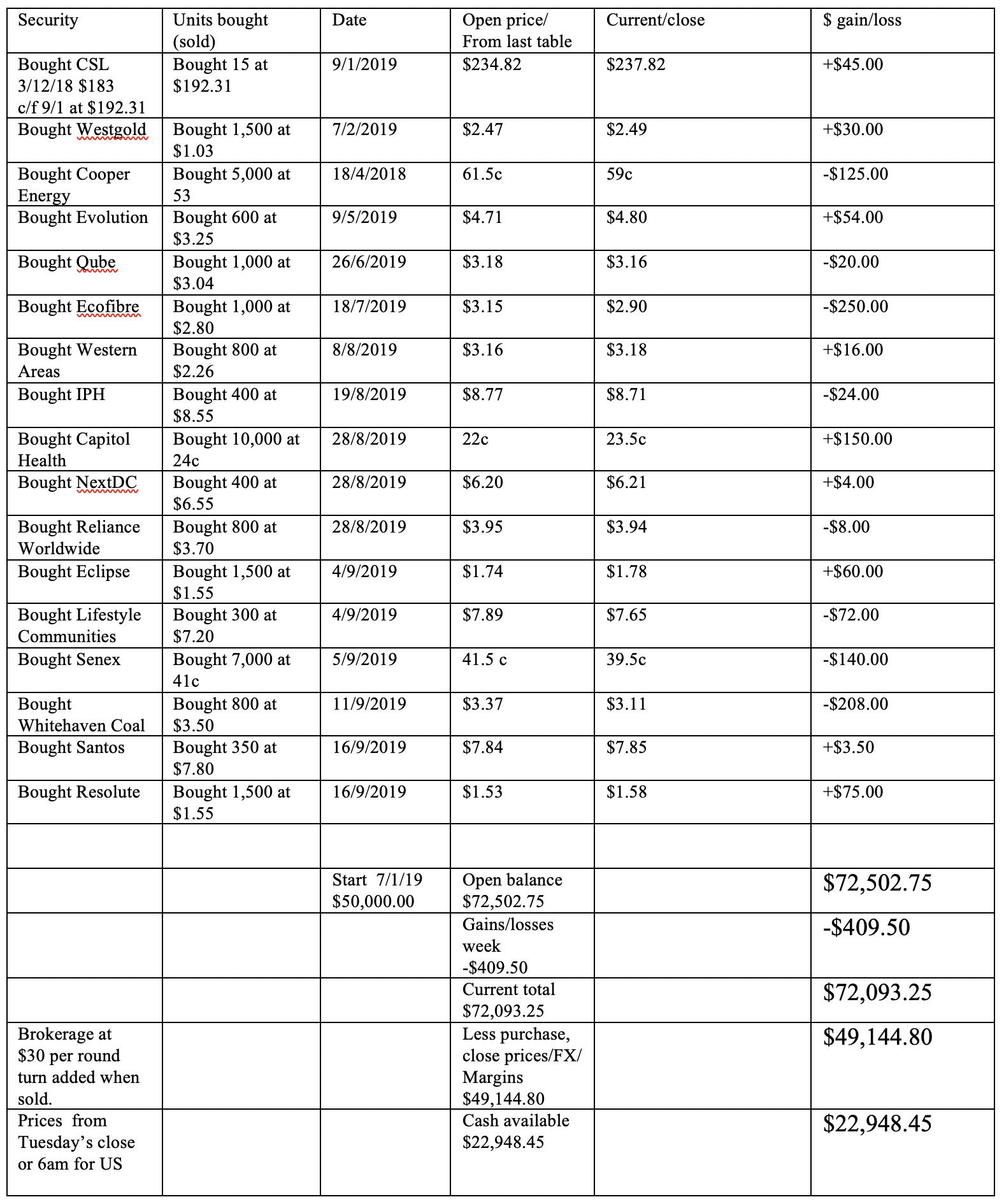

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here