The local market has pulled back from the highs and looks to be forming a bullish flag type continuation pattern.

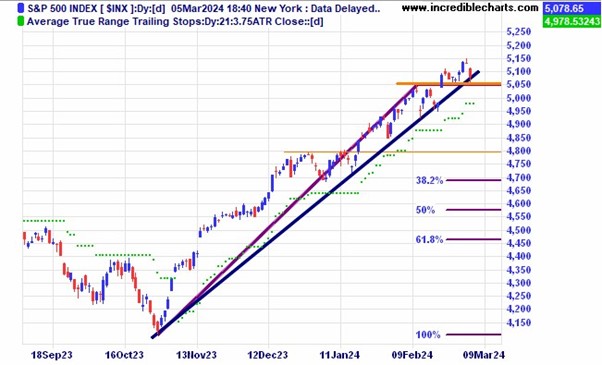

US markets have a case of the jitters before Fed reserve boss Jerome Powell gives his annual testimony before Congress. US jobs numbers out Friday may see further stock market falls..Time will tell. A fall to the 4,800 level could be considered by some analysts a decent pullback in an overall bull market.

The price of gold is looking bullish having broken out of a large sideways move and an equal range target of around $US2,430 looks promising over time.

Apple iPhone sales to China fell 24 per cent and the price of Apple shares continues to deteriorate with a double top pattern giving a target close to $US130.

Netwealth shares have poked above the recent highs.

Capricorn Metals shares could be set for a decent run if they reach an equal range target around $6.40.

Sandfire Resources may have a pullback to the breakout level before moving higher.

Can this support level for Data#3 hold over the coming months?

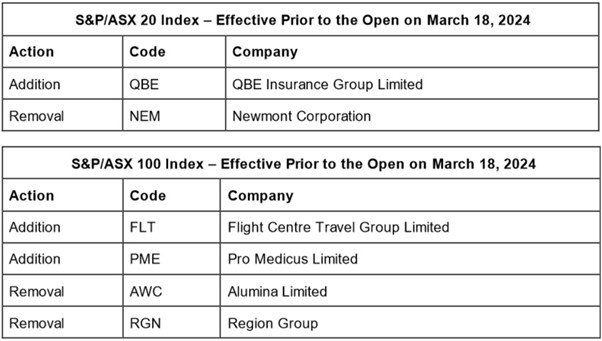

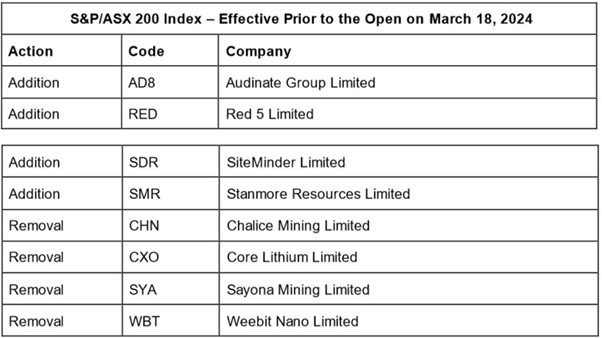

The coming changes to index constituents for the Australian market.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here